IBB jiminy

Your digital wealth management.

We combine the best of two worlds: digital and personal:

- Digital: become a customer conveniently from home and online

- Personal: IBB’s experts take care of your investment

8 good reasons

- Basic investment amount from €500

- Monthly savings contribution from €50 possible

- All-in fee: from 1.0% to 1.5%

- Flexible deposits and withdrawals

- No minimum term

- Global, actively managed investment portfolio

- Selection of excellent funds and ETFs

- Individuality through customizable theme modules

IBB jiminy

Your digital wealth management.

We combine the best of two worlds: digital and personal:

- Digital: become a customer conveniently from home and online

- Personal: IBB’s experts take care of your investment

8 good reasons for IBB jiminy

- Basic investment amount from € 500

- Monthly savings contribution from € 50 possible

- All-in fee: from 1.0 % to 1.5 %

- Flexible deposits and withdrawals

- No minimum term

- Global, actively managed investment portfolio

- Selection of excellent funds and ETFs

- Individuality through customizable theme modules

The most important facts about IBB jiminy

What goals can I pursue with IBB jiminy?

- Build up assets

- Protect assets

- Structuring assets

- Investing assets for the long term

Who is IBB jiminy for?

For anyone who is interested! – Whether you are an investment professional or have no prior knowledge – any private individual of legal age can use IBB jiminy.

How does IBB jiminy work?

Your portfolio is managed by IBB Expertise. The responsibility for the portfolio design is taken over for you, but you still have the opportunity to help shape it.

Choose the right one for you from four investment strategies. Our experts will manage your portfolio on this basis.

You can also choose which topics are important to you personally from our 12 topic modules.

What does our IBB jiminy cost?

| jiminy Investment strategy |

Investment amount | Service fee (All-in-Fee) p.a.* |

Performance Fee p.a.** | Hurdle Rate** |

| Conservative | From 500 € | 1,00 % | 10 % | 1 % |

| Income | From 500 € | 1,10 % | 10 % | 2 % |

| Growth | From 500 € | 1,25 % | 10 % | 3 % |

| Opportunity | From 500 € | 1,50 % | 10 % | 4 % |

* The percentages refer to the average assets under management (investment amount).

** The percentages refer to the asset growth.

**The performance fee is the fee charged on the excess performance as soon as the agreed minimum return (hurdle rate) is exceeded.

High watermark principle: The performance fee is only due when the mandate has reached a new all-time high. After years of falling prices, a new all-time high is therefore required before the performance fee is paid. The calculation is made at the end of the year.

* The percentages refer to the average assets under management (investment amount).

** The percentages refer to the asset growth.

** The performance fee is the fee charged on the excess performance as soon as the agreed minimum return (hurdle rate) is exceeded.

High watermark principle: The performance fee is only due when the mandate has reached a new all-time high. After years of falling prices, a new all-time high is therefore required before the performance fee is paid. The calculation is made at the end of the year.

Your advantages

We support you

We always keep an eye on your portfolio. We manage your portfolio on the basis of your specifications.

IBB jiminy invests in a globally managed fund portfolio. The selection process ensures that only the best products are included in your portfolio. The opportunities on the market are always exploited.

Individuality

You have the opportunity to help shape your portfolio by selecting topics yourself.

Transparency

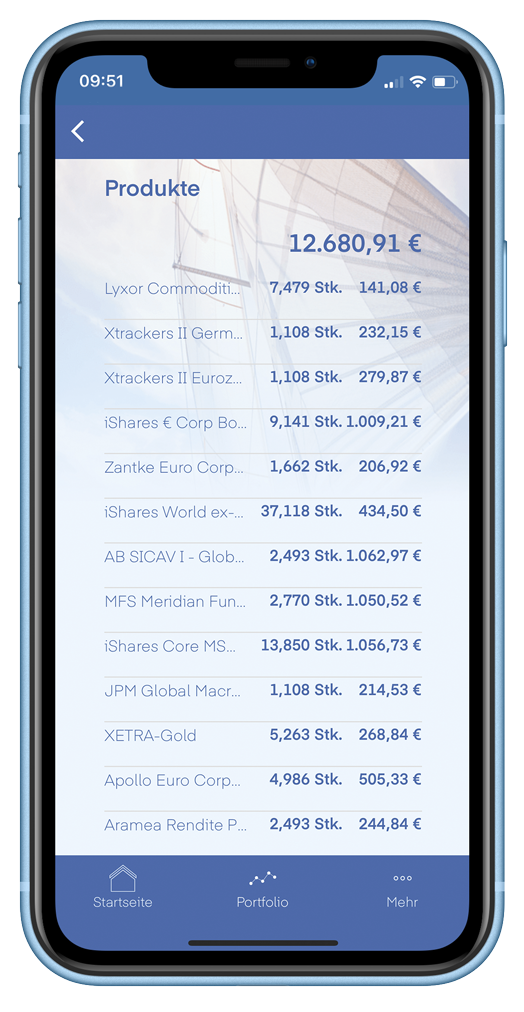

You can track the development of your portfolio in the app at any time.

You are in control at all times.

Costs

We keep your costs low and are transparent at the same time.

Flexibility

There is no minimum term for IBB jiminy. You can deposit and withdraw money with complete flexibility. In addition, you can set up any savings plans free of charge.

The way to IBB jiminy

IBB jiminy is set up completely digitally via the web application.

Important

Investment in capital markets is associated with risks and may lead to the complete loss of the invested assets. The “Basic Information on Securities and Other Investments” published by Bankverlag contains important information on the functioning of the financial instruments available and used in asset management and on the typical risks of loss associated with them. This basic information will be provided to you prior to the completion of the asset management contract and then additionally posted to your mailbox. You can retrieve this basic information via the mailbox at any time. The amount of the asset management fee can be found in the cost sheet prior to the conclusion of the contract.

Who is behind IBB jiminy?

WE! – the IBB (Internationales Bankhaus Bodensee AG)

Your personal private bank. We are the bank in the Würth Group.

Investify is our technology partner and your contractual partner for asset management. Investify provides the optimal digital solution for your asset management and the implementation of regulatory requirements.

What is your right investment strategy?

We offer you four different investment strategies to choose from.

Conservative

The “Conservative” portfolio aims to achieve real capital preservation. Fluctuations in value should be kept to a minimum. Defensive investments form the investment focus. The maximum equity weighting is 15 percent.

Income

The “Income” portfolio aims to achieve returns in excess of real capital preservation. To this end, defensive and dynamic investments are combined in such a way that the risks remain moderate. The equity weighting is between 20 and 30 percent.

Growth

The “Growth” portfolio is composed of several investment components in a balanced manner. The aim is to achieve higher long-term capital returns with reasonable fluctuations in value. The equity weighting is between 40 and 60 percent.

Opportunity

The “Opportunity” portfolio aims to achieve a high return on capital. It mainly uses dynamic investments, which may be associated with higher fluctuations in value. The equity weighting is between 70 and 100 percent.

Add topics that are important to you to your portfolio

How to become a customer

01

Define system requirements and specifications

Here we ask questions to understand your investment requirements and determine your investment strategy.

02

03

04

Download the free IBB jiminy app and open a custody account online

Here you have to legitimize yourself. This is done via IDnow. You will need your ID card, your tax identification number and your bank details.

You will then be redirected to our partner Baader Bank. Here you can open your custody account.

Download the app now and get started

Use the online investment route. This will guide you through the 4 simple investment modules.

You can download the IBB jiminy app for your respective device here.

Do you still have questions?

Our advisory team is available Mon.- Fri. from 08:30 – 18:00 – you can reach us at:

Take a look at our FAQs – we can already answer many questions here.

App

General information about the app

Where can I download the IBB jiminy app?

You can find the app directly by searching for investify in the Google Playstore or iTunes, and the following links will take you directly to our app.

- On Android in the Google Playstore

- On iOs in the App Store

Does the IBB jiminy app incur costs for me?

There are no costs for you for downloading and using the app. However, mobile data traffic may incur additional costs.

Security

Security of your investment

How are my securities hedged?

What are special assets?

The ETFs and active funds used in your portfolio are considered special assets that are not included in the assets of the custodian bank. In the event of insolvency of the custodian bank or asset manager, the capital invested in the fund is not included in the bankruptcy estate. Neither the creditors of the custodian bank nor of the asset manager have any claim or access to the corresponding assets.

Privacy

How is my data protected?

What technical standards does IBB jiminy adhere to?

Your data (password)

Access data

What access data is available and what is it needed for?

Login password: When registering, you enter your e-mail address and choose a personal login password of at least six digits. This allows you to log in to my IBB jiminy or our app at any time.

What can I do if I have forgotten my login password or would like to change my login password?

If you have forgotten your login password, please enter the e-mail address you used to register with us in the login mask. In the next step, click on “Forgot password” below the input mask. You will then receive an e-mail from us with instructions on how to set a new password.

We will be happy to help you with your registration. Please send us a message with your personal details to service(at)investify.com.

We will be happy to help you with your registration. Please send us a message with your personal details to kontakt(at)ibb-ag.com.

Payments

General information on payments

Are there any fees for deposits or withdrawals?

How are payment transactions authenticated?

Every deposit and withdrawal ordered and every change to your investment (e.g. an adjustment to your investment profile or a change to your investment themes) must be confirmed in the investify app. In this way, we also ensure that the payment transactions and contract adjustments you have ordered have been initiated by you. In the next step, click on “Forgot password” below the input mask. You will then receive an e-mail from us with instructions on how to set a new password.

What is a reference account?

How can I change the details of my reference account?

Please complete the form to change your reference account and send it to kontakt(at)ibb-ag.com. We will do the rest for you.

Deposits

How does the first deposit work?

What happens after a deposit?

After a deposit, we invest your money according to your investment profile.

How can I make further deposits?

You can make deposits to your clearing account at Baader Bank AG at any time.

You can find the IBAN of the settlement account in the app under “Invest more”, or in the deposits/withdrawals section of the my IBB jiminy customer application, as well as in the main menu sub-item “Contract data”.

How can I create a savings plan?

You can create a savings plan via the customer application my IBB jiminy, in the SEPA savings plan dashboard area (to the savings plan). The savings installment is collected in the first week of the month.

However, you can also set up a flexible monthly savings installment by standing order to your clearing account at Baader Bank AG. You can find the IBAN of the settlement account in the app or in the deposits/withdrawals section of the my IBB jiminy customer application.

Withdrawals

How can I make withdrawals?

How long does it take for a payout to reach my reference account?

As soon as we receive your payout request, the corresponding securities will be sold. Due to the value date of individual products, this may take around 7 bank working days. The transfer to your reference account will then take place immediately.

To which account can I make withdrawals?

Payouts are only possible to your reference account. In this way, we ensure that payouts are never transferred to a third-party account.

Contract and fees

General information on the contract

At which bank is my custody account held?

Is there a minimum term?

How can I have a power of attorney issued for my account?

You have the option of granting a person you trust a power of attorney for your custody account and your clearing account with Baader Bank AG. You can find further information here.

How can I cancel the contract with IBB jiminy?

Please send us an informal, signed revocation in which you request us to close the custody account and account at the end of the asset management period. Please state your customer number so that we can clearly identify you. You can send us the letter by e-mail to kontakt(at)ibb-ag.com. We will take care of further communication with Baader Bank for you.

How can I cancel the contract with IBB jiminy?

Please send us an informal, signed revocation in which you request us to close the custody account and account at the end of the asset management period. Please state your customer number so that we can clearly identify you. You can send us the letter by e-mail to kontakt(at)ibb-ag.com. We will take care of further communication with Baader Bank for you.

How can I terminate my contract with IBB jiminy?

What is the notice period for my asset management contract?

What costs will I incur in the event of termination?

Cancellation is free of charge for you.

Fees and costs

What fees are charged for account and custody account management?

When is the asset management fee collected?

Where can I view the fees I have paid?

Taxes

Are there taxes on capital gains?

What is an exemption order?

With an exemption order, you can instruct your bank to exempt a maximum of EUR 1,000 per year as an individual or EUR 2,000 per year as a spouse/partner from withholding tax on investment income.

How can I set up an exemption order?

Please send the exemption order to Baader Bank by e-mail, fax or post, stating your Baader Bank reference number:

Baader Bank Aktiengesellschaft

Weihenstephaner Str. 4

85716 Unterschleißheim

Unterschleißheim, Germany

Fax: +49 89 5150 1111

E-mail: kundenservice(at)baaderbank.de

Further information can be found here.

How can I apply for a loss certificate?

Please send your application for a certificate of loss by e-mail, fax or post, stating your Baader Bank reference number:

Baader Bank Aktiengesellschaft

Weihenstephaner Str. 4

85716 Unterschleißheim

Unterschleißheim, Germany

Fax: +49 89 5150 1111

E-mail: kundenservice(at)baaderbank.de

Further information can be found here.

Where and when will I receive the tax certificate for my IBB jiminy custody account?

Your investment

General information on the portfolio

What is the minimum investment amount?

The minimum investment amount is € 500.00. It is possible to set up a monthly savings plan for as little as €50.

Where can I view the performance data for the IBB jiminy investment strategies?

You can find our performance to date in our performance overview.

Reporting

What reports does Baader Bank AG provide me with?

Baader Bank AG documents every securities transaction for you. To access this information, please log in to my IBB jiminy. You will find all account statements from Baader Bank on your dashboard in the “My contracts and documents” section.

What reports does IBB jiminy provide me with?

Every quarter, we deliver a comprehensive report that goes into detail about your portfolio. You receive information on your return, a comparison with the benchmark, an overview of investify’s range of themes and the fees due. 100% transparent.

What is a loss threshold report?

The loss threshold report is an automatic notification that you receive if losses occur within a quarter that reach or exceed the statutory loss threshold of ten percent.

Become a client

Requirements

Who can become a client?

How long does it take to open my custody account?

Can I remain a customer if I move my place of residence?

If you are moving to another country, please contact our customer support.

Can I open a custody account for minors?

It is currently not possible to open a custody account for minors.

Does IBB jiminy offer joint accounts?

As we create a personalized investment profile for each client, we do not currently offer joint accounts. You can, of course, grant powers of attorney for your account and custody account to people you trust. You can find more information on this here.

Can I open a custody account for a legal entity?

Registration

Is registration free of charge?

Registration with IBB jiminy is of course free of charge for you.

Log in

How can I become a customer?

What is the investment profile?

What documents do I need to register?

What is a registration certificate?

What is a registration address?

Identify

How does the identification process work?

How does the identification process work?

Why does identification have to be carried out?

Which ID documents can I use to identify myself?

When can I use video identification?

How strong should my Internet connection be?

What does video identification cost me?

Identification is completely free of charge for you. We will pay the fees for you.

How secure is the identification and my data?

IDnow adheres to the strictest data protection guidelines and has been certified for this. Only employees specially trained in accordance with legal requirements come into contact with your data. All data is encrypted several times in accordance with the highest technical security standards and is always transmitted securely. The data is securely encrypted and stored on high-security servers in bank data centers within Germany that specialize in sensitive data. All data is transferred from IDnow to investify in fully encrypted form and then deleted by IDnow.

What happens to my data?

Your data will only be stored for identification and documentation purposes. Details can be found in IDnow’s privacy policy. In accordance with this, your data will be transmitted to us and deleted from the IDnow servers after 90 days at the latest.